Accept a payment

Learn how to use Fintoc's API to accept one-time payments

There are three steps to accept payments using Fintoc:

- On your backend, create a

Checkout Sessionusing your Secret Key - Redirect your user to complete the payment on the Fintoc-hosted checkout page

- Handle post-payments events

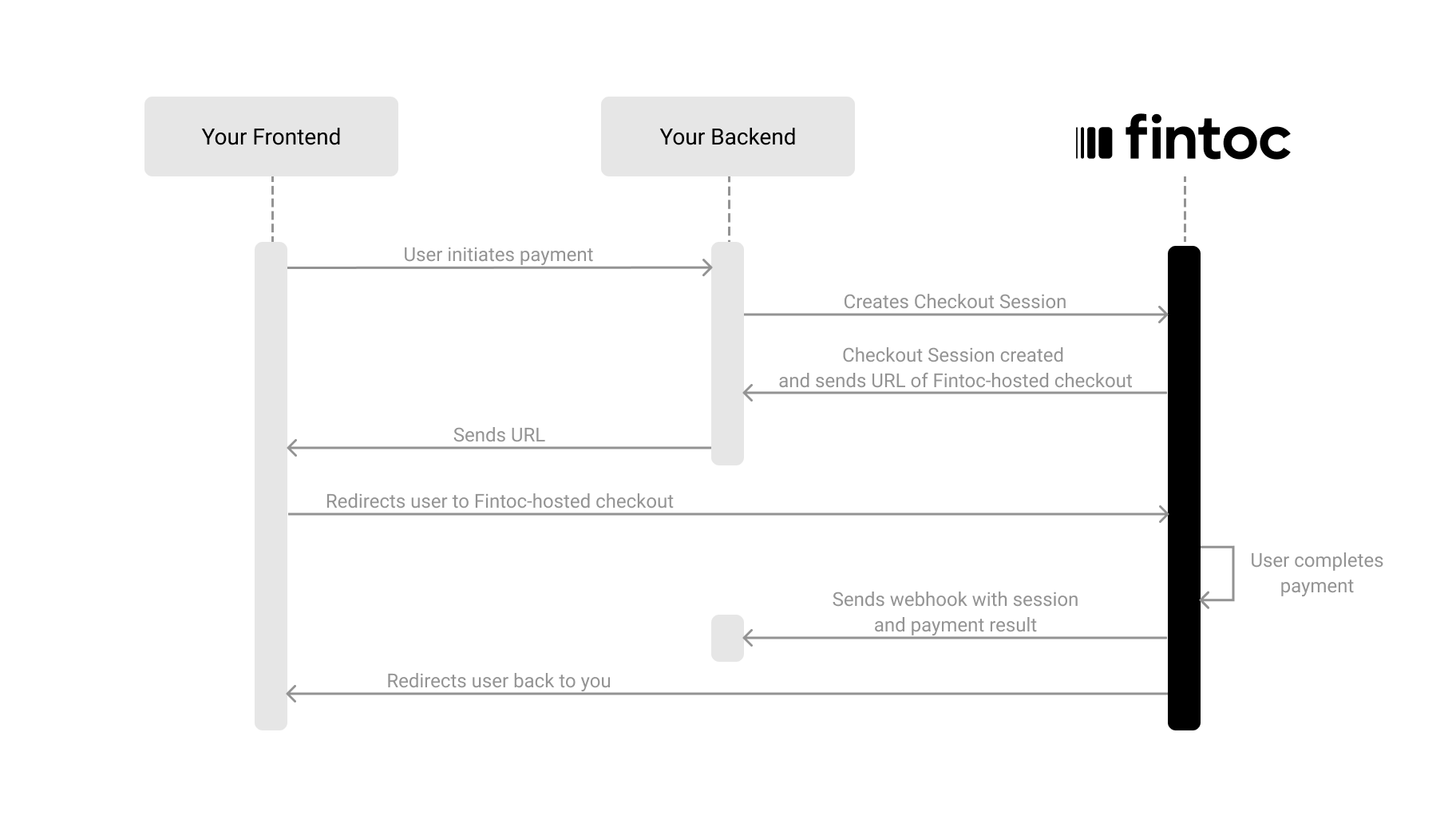

The following diagram shows how Fintoc interacts with both your backend and your frontend

Optional: install our backend SDK

If you’re using Python, you can install our Python SDK to make it easier to interact with our API. The SDK automatically handles pagination, lets you easily verify Fintoc's webhooks, and offers many other helpful features.

pip install fintocCreate a session

The Checkout Session object represents your intent to collect a payment from a customer and tracks state changes throughout the payment process.

Using your Secret Key, create a Checkout Session from your backend with the required parameters: amount, currency, success_urland cancel_url like the example bellow:

curl --request POST "https://api.fintoc.com/v2/checkout_sessions" \

--header "Authorization: YOUR_TEST_SECRET_API_KEY" \

--header "Content-Type: application/json" \

--data-raw '{

"amount": 350000,

"currency": "CLP",

"success_url": "https://merchant.com/success",

"cancel_url": "https://merchant.com/987654321",

"customer": {

"tax_id": {

"type": "cl_rut",

"value": "12088191"

},

"name": "Felipe Castro",

"email": "[email protected]",

"metadata": {}

},

"metadata": {

"order": "987654321"

}

}'const { Fintoc } = require('fintoc');

const fintoc = new Fintoc('YOUR_SECRET_KEY');

const checkoutSession = await fintoc.checkoutSessions.create({

amount: 1000,

currency: 'mxn',

customer_email: '[email protected]'

});from fintoc import Fintoc

client = Fintoc('YOUR_TEST_SECRET_API_KEY')

checkout_session = client.checkout_sessions.create(

amount=1000,

currency='clp',

customer_email='[email protected]'

)require 'net/http'

require 'uri'

require 'json'

checkout_session = {

amount: 1000,

currency: 'clp',

customer_email: '[email protected]'

}

uri = URI("https://api.fintoc.com/v1/checkout_sessions")

header = {

Accept: 'application/json', Authorization: 'YOUR_TEST_SECRET_API_KEY'

}

http = Net::HTTP.new(uri.host, uri.port)

request = Net::HTTP::Post.new(uri.request_uri, header)

request.body = checkout_session.to_json

response = http.request(request)Parameter | Example | Description |

|---|---|---|

| 2476 | Required amount of money that needs to be paid. It's represented as integer with no decimals in the smallest possible unit of the currency you are using. If your payment uses Chilean peso, an amount of CLP 2476 is represented as 2476. If your payment uses Mexican peso, an amount of MXN 24.76 is represented as 2476. |

| CLP | Required currency that is being used for the payment. We currently support CLP and MXN. |

|

| Required URL to redirect the user in case of payment succeeded. |

|

| Required URL to redirect the user in case they decide to cancel the payment and return to your website. |

|

| Optional set of key-value pairs that you can attach to an object. This can be useful for storing additional information about the object in a structured format. |

Send the Business Profile object if you are processing payments for a submerchantYou can also add the

business_profileobject when creating a session to customize the name displayed as the "Recipient" on the payment flow.

Include Customer Data (Optional)

When creating a Checkout Session, you can include customer information. This allows Fintoc to display only the available payment methods for that specific customer, such as verifying if the amount exceeds the transaction limit for a selected bank in the payment initiation method.

Attribute | Type | Description |

|---|---|---|

|

| Object that identifies the customer at a fiscal or regulatory level. It includes a One of |

|

| Optional full name of the customer. |

|

| Customer email linked to a Checkout Session. This is used to notify a user in case of a refund. One of tax_id or email is required |

|

| Optional custom data that can store additional information about the customer (e.g., internal IDs, CRM references, or tags) |

Bank specific payment flows for business accounts and high amountsIn bank_transfer payments in Chile, if the the payment is above the transaction limits or you send a

customerwith atax_id.valueof a business instead of a natural person, Fintoc will allow only banks that has special payment flows for tis type of transactions (Banco Estado, Banco de Chile and Banco Santander). You can test it use this credentials.

Pre-select a Payment Method (Optional)

You can create a Checkout Session without specifying payment methods. In this case, users can select from all available options on the Fintoc-hosted checkout page, based on the session parameters (amount, customer, currency) and the payment methods you have enabled in Fintoc.

Alternatively, you can explicitly define the payment method(s) for the session. For example, in the request below, the payment_initiation method is set, combined with payment_method_options, where the institution cl_banco_estado is pre-selected for the user. In this scenario, the payment flow presented to the user will be limited to this specific method and bank.

curl --request POST "https://api.fintoc.com/v2/checkout_sessions" \

--header "Authorization: YOUR_TEST_SECRET_API_KEY" \

--header "Content-Type: application/json" \

--data-raw '{

"amount": 350000,

"currency": "CLP",

"success_url": "https://merchant.com/success",

"cancel_url": "https://merchant.com/987654321",

"payment_methods": ["payment_initiation"],

"payment_method_options": {

"payment_initiation": {

"institution_id": "cl_banco_estado"

}

},

"customer_data": {

"tax_id": {

"type": "cl_rut",

"value": "12088191"

},

"name": "Felipe Castro",

"email": "[email protected]",

"metadata": {}

}

}'const { Fintoc } = require('fintoc');

const fintoc = new Fintoc('YOUR_SECRET_KEY');

const checkoutSession = await fintoc.checkoutSessions.create({

amount: 1000,

currency: 'mxn',

customer_email: '[email protected]'

});from fintoc import Fintoc

client = Fintoc('YOUR_TEST_SECRET_API_KEY')

checkout_session = client.checkout_sessions.create(

amount=1000,

currency='clp',

customer_email='[email protected]'

)require 'net/http'

require 'uri'

require 'json'

checkout_session = {

amount: 1000,

currency: 'clp',

customer_email: '[email protected]'

}

uri = URI("https://api.fintoc.com/v1/checkout_sessions")

header = {

Accept: 'application/json', Authorization: 'YOUR_TEST_SECRET_API_KEY'

}

http = Net::HTTP.new(uri.host, uri.port)

request = Net::HTTP::Post.new(uri.request_uri, header)

request.body = checkout_session.to_json

response = http.request(request)| Attribute | Type | Description |

|---|---|---|

payment_methods | array of strings | Optional definition of the available payment method(s) for the session. Methods current available are payment_intent (bank transfers) and card |

payment_method_options | hash | Optional array of settings for each available payment method |

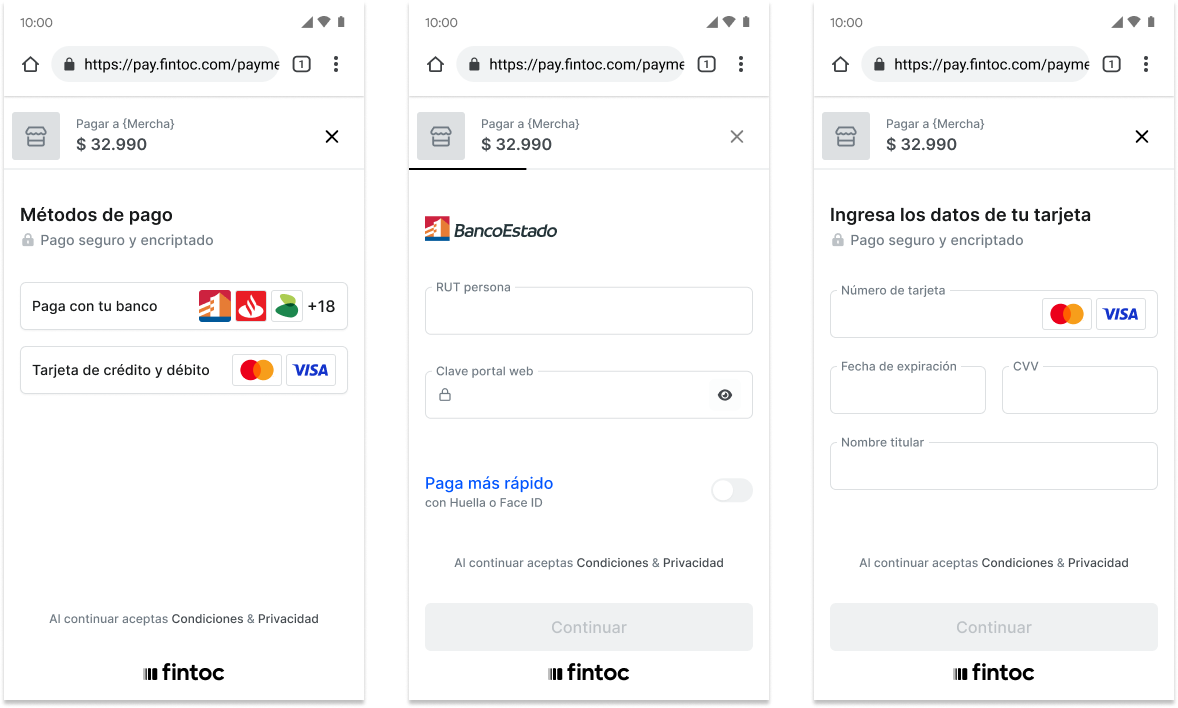

Left: Default view showing all available methods (bank transfer and cards) when no payment_method parameter is set. Center: Pre-selected bank transfer flow for Banco Estado, displaying the institution-specific payment form directly. Right: Pre-selected cardflow.

Using your own Checkout PageWhen you have your own checkout page, you should set the

payment_methodto redirect users to the Fintoc-hosted checkout after they've already selected their preferred payment method.This skips Fintoc's payment method selection screen and directs users straight to the specific payment flow, instead of letting Fintoc manage the full checkout experience.

Response when creating a Checkout Session

After making the request to create the Checkout Session, Fintoc should respond with something like this:

{

"id": "cs_li5531onlFDi235",

"object": "checkout_session",

"mode": "test",

"status": "created",

"amount": 350000,

"currency": "CLP",

"created_at": "2024-06-04T15:32:46.721Z",

"updated_at": "2024-06-04T15:32:46.721Z",

"success_url": "https://merchant.com/success",

"cancel_url": "https://merchant.com/987654321",

"redirect_url": "https://checkout.fintoc.com/checkout_session_01HXY3Z7X5YQ54V8G2E1KJQAVF",

"metadata": {},

"customer": {

"name": "Felipe Castro",

"email": "[email protected]",

"metadata": {},

"tax_id": {

"type": "cl_rut",

"value": "12088191"

}

}

}In the response, you should receive the redirect_url attribute. In the following step, you'll use this attribute to redirect the user to complete the payment.

Redirect the user to complete the payment

Next, you will redirect users to the Fintoc-hosted checkout page. After completing the payment, they'll be automatically redirected back to your site.

Based on the payment result, the user will be redirected to either the success or cancel URL.

Handle post-payments events

Once a Checkout Session finishes, you handle the payment result in your frontend and complete the payment in your backend. For your backend, you will use the events sent by webhooks.

Complete the payment on your backend

Fintoc sends a checkout_session.finished and a payment_intent.succeeded event when the session completes and the payment is successful. Use the follow the webhook guide to receive these events and run actions, such as sending an order confirmation email to your customer, logging the sale in a database, or starting a shipping workflow.

The checkout_session.finished event includes information about the session and the payment_intent:

{

"id": "evt_a4xK32BanKWYn",

"object": "event",

"type": "checkout_session.finished",

"data": {

"id": "cs_li5531onlFDi235",

"mode": "test",

"amount": 350000,

"object": "checkout_session",

"status": "finished",

"currency": "CLP",

"metadata": {},

"cancel_url": "https://merchant.com/987654321",

"created_at": "2026-01-13T18:48:25Z",

"expires_at": "2026-01-14T18:48:25Z",

"success_url": "https://merchant.com/success",

"redirect_url": "https://checkout.fintoc.com/checkout_session_01HXY3Z7X5YQ54V8G2E1KJQAVF",

"session_token": null,

"customer_email": null,

"customer": {

"name": "Felipe Castro",

"email": "[email protected]",

"metadata": {},

"tax_id": {

"type": "cl_rut",

"value": "12088191"

}

},

"payment_methods": [

"payment_intent"

],

"business_profile": {},

"payment_resource": {

"payment_intent": {

"id": "pi_38DNJo3rbvGUzKFvCGZ6dxR1Kxx",

"mode": "test",

"amount": 350000,

"object": "payment_intent",

"status": "succeeded",

"currency": "CLP",

"metadata": {},

"created_at": "2026-01-13T18:48:31Z",

"expires_at": "2026-01-14T18:48:25Z",

"error_reason": null,

"payment_type": "bank_transfer",

"reference_id": null,

"widget_token": null,

"customer_email": null,

"sender_account": {

"type": "checking_account",

"number": "813990168",

"holder_id": "415792638",

"institution_id": "cl_banco_falabella"

},

"business_profile": {},

"transaction_date": null,

"recipient_account": null,

"payment_type_options": {}

}

},

"payment_method_options": {}

}

}

You should handle the following post-payment events :

Event | Description | Action |

|---|---|---|

| Sent when a payment associated to a Checkout Session reaches a final state | Complete the order based on the payment's status |

| Sent when a session expires | Offer the customer another attempt to pay. |

| Sent when the payment related to a checkout session succeeds. | Confirm the customer's order |

| Sent when the payment related to a checkout session fails. | Offer the customer another attempt to pay. |

| Sent when the payment related to a checkout session needs an action from the user. It will be received when a | Inform your user the action needed to approve the payment, based on the |

Handling async payments after the Checkout Session endsIn some cases, the Checkout Session may finish with a payment that does not yet have a final status, such as

requires_action. This can happen, for example, when a bank transfer from a business account requires approval from more than one representative.In these cases, when receiving the

payment_intent.requires_actionyou should inform the user that the payment is pending approval. Once you receive either thepayment_intent.succeededorpayment_intent.failedevent, you should notify the user of the final payment status as soon as it is confirmed.

Test your integration

Using your test mode API Secret Key, you can create payments that simulate successful and failed outcomes without moving any money.

This lets you validate your full payment flow end-to-end:

- Your backend API requests (creating sessions and handling responses)

- The redirect flow from your frontend to the

redirect_urland back to thesuccess_urlorcancel_urlafter the payment - Webhook for post-payment events

To learn how to trigger specific scenarios, use the test credentials and special test values described in our testing guide.

Updated 7 days ago