Payment scenarios

Learn how Fintoc supports your use case

Fintoc supports two payment scenarios depending on the countries you operate in. Start with the type of business you are building the integration for and use the table below to identify the best type of integration.

Payment scenario | Description | Best for | Supported in |

|---|---|---|---|

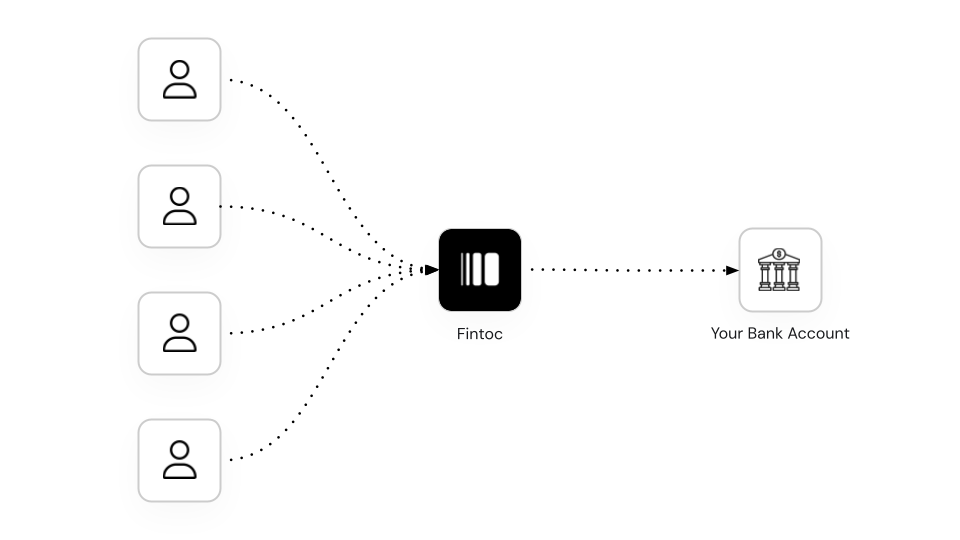

Fintoc collects | When your customer makes a payment, the money goes to a bank account managed by Fintoc. Then, based on your selected payout schedule, Fintoc sends the money to your bank account. Fintoc is in the flow of funds. | E-commerces or any company selling goods or services online | Chile and Mexico |

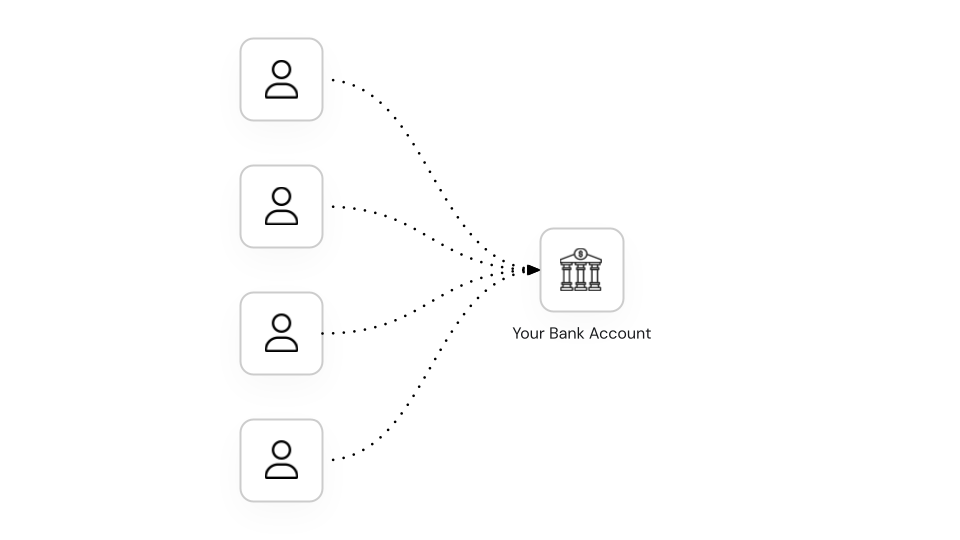

Direct payments | When your customer makes a bank transfer payment, the money goes directly to your specified bank account. Fintoc is not in the flow of funds. | Fintech companies like wallets, neo banks, and p2p applications | Chile |

Fintoc collects

When Fintoc collects your payments, the money goes to a bank account managed by Fintoc. Fintoc tracks and matches when the payments settle on the account. We also handle any external payment —payments using an external channel, such as a regular bank transfer— to this account for you. Then, depending on your payout schedule, Fintoc sends the funds to your bank account. Fintoc discounts your application fees directly from your payouts.

Advantage | Disadvantage |

|---|---|

Simple to operate with. You don't need to track and match the Fintoc payments you receive in your account, nor handle external bank transfers. Fintoc does this for you. | Funds arrive in your bank account with a delay. Usually the next business day. See the receiving payouts guide for more information. |

We recommend this type of integration for e-commerces or any company that wants to receive payments but doesn't want to handle complex operations or edge cases.

Direct payments

Only available in Chile and for bank transfer paymentsFor now direct payments is only available in Chile and for payments of the method bank transfer.

In direct payments, the money flows directly from your customer's bank account to the recipient account you specify.

If you collect the money in a single bank account, you'll need to periodically download your bank statement, run a reconciliation process to track and match Fintoc payments and handle any external bank transfers you may receive.

| Advantage | Disadvantage |

|---|---|

| The funds arrive instantly in the recipient's bank account. | You need to run complex reconciliation processes to handle external bank transfers, and track and match Fintoc payments. |

Updated 20 days ago